If you are accustomed to the crypto world somehow, you are likely to know about network fees. These are small amounts of coins anyone sends as a reward for miners when doing any kind of transaction in blockchain. The bigger network fee, the higher the priority of your transaction. In some cases, you may encounter unfortunate issues related to large network fees and a smaller output amount, as s result. Eventually, you may wonder how come the output amount turned out to be way smaller than expected. In most cases, the answer is in floating network fees that are always deducted from the amount to send.

What do network fees depend on?

Actually, the network load determines how much you should pay miners for your transaction. Imagine your transaction going up for auction, where your bid is the transaction fee. It if is more than average, chances are, your transaction will be processed faster. The average transaction fee can fluctuate depending on the number of transactions pending. Simply put, if the network is overloaded, the average network fees increase. Likewise, if it comes back to normal or doesn’t have any backlog, the fees become much lower.

What about Bitcoin and Ethereum network fees?

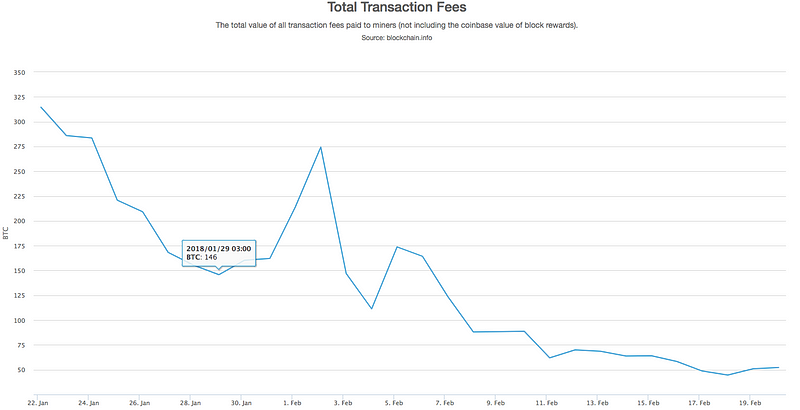

If you remember Bitcoin mass hysteria at the end of 2017, you may know how outrageous the network fees may be. In comparison with that moment, the current Bitcoin network fee of transactions made through Changelly has dramatically decreased — to only 0,00065 BTC.

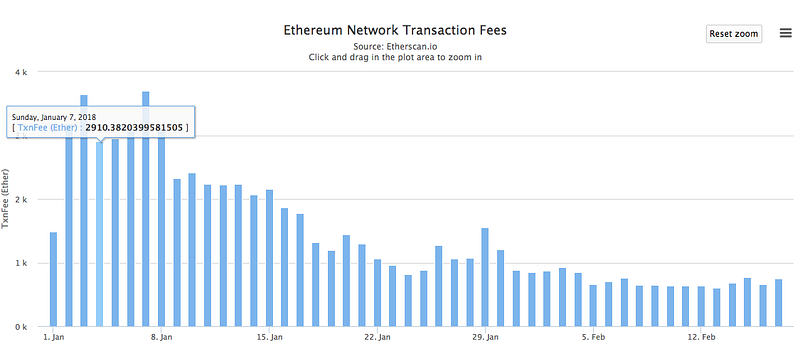

Same is relevant for Ethereum. Over the last month, the network fee has dropped down from 0.00063 to 0.000315 ETH on average.

High times for exchanging

The market is calm. The network fees are comfortable. The volatility is low. Hence, if you’ve ever wished to buy crypto, this is the very moment to do it without freaking out of every sudden market swing.

With Changelly, you can do it in a few clicks, whether you’re about to exchange one crypto asset to another or buy it with your bank card.